… to tell us what neo-classical economists never could. Read this. And then, if you are a neo-classical economist, try fitting it in your spreadsheet.

Joris Luyendijk writes a banking blog for The Guardian.

After some reflection, I think that the Vickers report is too tame, driven by some rather weak desire to be different to the US re-regulation of the finance industry. Britain should be different by doing better than US re-regulation.

The place I would start would be by turning the retail banking operations of RBS, and perhaps Lloyds as well, into mutuals, controlled by employees and depositors and restricted to doing what the customers want and think is right. Of course, this is not simple. I bank with Nationwide, which offers better service and costs than normal banks, but whose senior management still spends too much time aping the behaviour of bankers rather than trying to think like a mutual society. We should go mutual at the retail level and concurrently improve mutual governance and incentives for mutuals to lend in ways that are profitable and help the economy (like encouraging them to develop project finance units for business lending).

Beyond that, no ring-fence. Just a total separation of the retail and industrial working capital functions of the banking system from more speculative activities. The bankers say it can’t be done. But that is because they don’t want it to be done.

It can be done. It just requires the political cojones.

More:

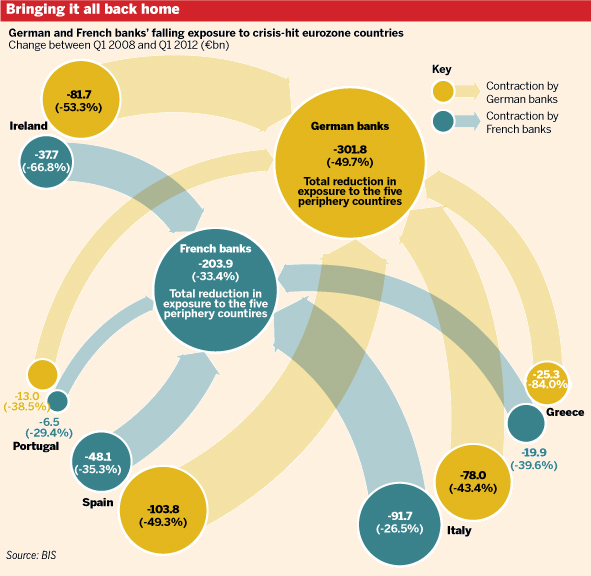

Bank of England calculates a £27bn capital shortfall at UK banks at end 2012 as the deleveraging process continues. Reported in the FT (sub needed) here. Reported here in The Guardian, which notes that Nationwide was only short £400m. Note that the capital shortfalls will largely be paid up by the poor, who do not own equities and keep what little money they have in banks, which pay no interest as a result of the financial crisis. The poor are also beginning to pay in terms of rising inflation. Socialism for the rich, mon brave, capitalism for the proles!

Even more:

Just seen that Obama repeatedly referred to George Osborne as ‘Jeffrey’ at G8. Then he claimed he was confusing George with his ‘favourite’ r&b artiste, Jeffrey Osborne. Surely this is some bad-ass mind games? Obama can’t really like Jeffrey Osborne, can he? On the Wings of Love? What he’s really saying is that Jeffrey Osborne is probably George Osborne’s idea of an r&b artiste… I am actually sitting here feeling sorry for George.

Next day:

Spurred on by the anthropologist, Martin Wolf makes his boldest statement on bank/financial system reform (that I have seen) in the FT (sub needed). Not sure why they aren’t flagging it on the front page just now (FT pension fund all in bank stocks?). I agree with most of what Wolf says, though I reiterate that this ring-fence idea is silly. If the Americans don’t need it – and the concomitant risk – why do we? Also, I don’t think we need special laws for locking up bankers. I am as keen as the next man to see some City types doing time, but it should be done through regular legislation. The game is to have a simple regulatory structure that forces the money people to write stuff down, so that when they break the law there is a piece of paper that the lawyer can hold up in court and say: ‘M’lud, this asshole needs to go to prison.’ If you want a good new law, let’s have one to make the granting of honours in the British system a matter for an independent panel, so that people like Fred the Shred and Howard Davies don’t get knighthoods in the first place.

A reader sends in this link to a Youtube video. It’s kind of funny, although the authors of the skit don’t understand the first thing about John Maynard Keynes, judging from the lyrics. It’s kind of British liberal Tea Party humour, if that is possible, which I guess it must be because they’ve done it. Thank god it’s Friday…