The FT decides that what I predicted in 2010 has already come true — namely an equity market bubble. I have been thinking about this myself and am more prone to concur with Krugman that this is not yet a bubble. Meanwhile, the answer to one of the sub-questions Krugman poses — about the strength of corporate profits in the last two years — is probably the one given by Hyman Minsky. Minsky argued that financial crises in countries where governments are a large share of the economy are perversely good periods for corporate profitability as costs fall but government steps in to make up for missing private sector demand (in this latest case more with QE than with direct fiscal action, but with a fair bit of the latter in the US).

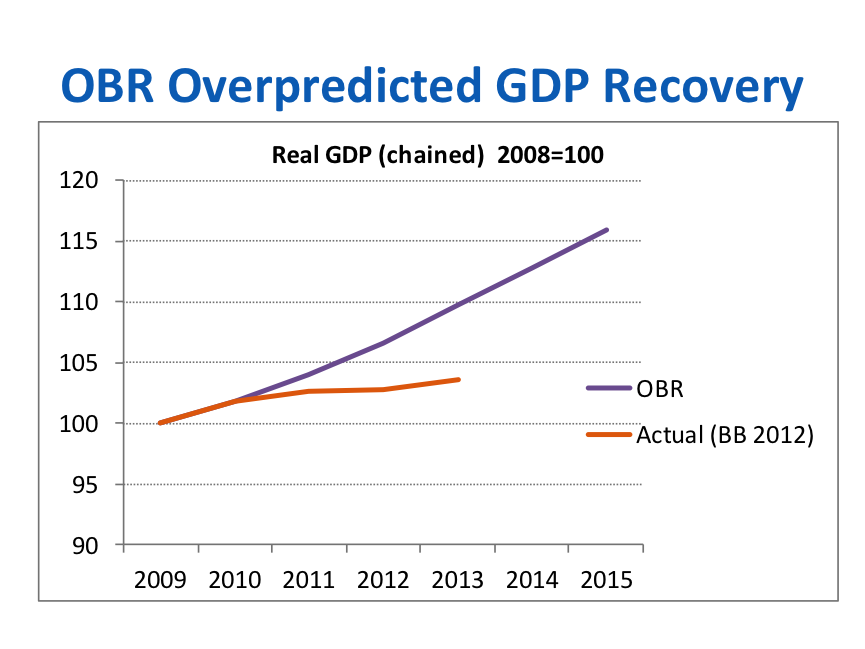

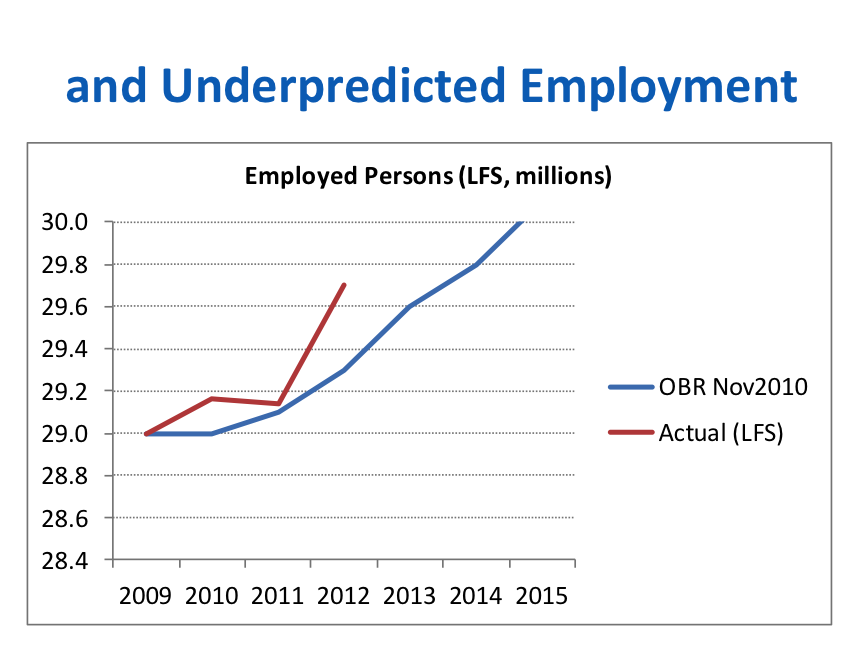

Another sub-question is why employment has held up much better in the UK (less fiscal stimulus versus the US) than almost anyone predicted (see charts below showing forecasts by the British government’s Office of Budgetary Responsibility. Graham Gudgin, who provided these graphs, argues that employment has been better than expected in Britain because very low interest rates have benefited firms’ cash flows (highly sensitive to interest rates) and encouraged them to hang on to staff, even as they rein in capital expenditure. Firms can be profitable and maintain reasonable employment levels even as they doubt the economic outlook. This sounds plausible, but if true it suggests, as Gudgin further argues, that unemployment is unlikely to fall more as QE is reduced, and then interest rates rise. In other words, on the present policy trajectory, the employment outlook in the UK is less sanguine than most people believe.

Tangentially related, here is a piece from John Kay from earlier this month that is worth reading if you want to understand the sneaky moves George Osborne is making towards creating a British Fannie Mae (60 years after the US one was actually needed), and thereby creating off-balance sheet financial risk in a manner that both Blairite and Cameronite governments been guilty of. As Kay says, Osborne should support the construction sector by increasing housing supply by on-the-books investment, not through voodoo accounting that encourages more turnover of the existing stock of property. It is hard to know whether to dislike him more for the narrowness of this thinking or for his political sliminess.

Tags: bubbles, financial crisis