It isn’t yet Custer’s last stand, for Euroland is the longest Hollywood movie ever made. But Flexible Mario’s press conference today gave us the predictable shape of the final showdown.

Mario’s ECB holds in one hand the promise of unlimited sovereign bond purchases of up to three years maturity (this may include buying long bonds with less than three years to expiry, his language was unclear on the detail). The seniority of the ECB claim on the bonds will be no greater than that of private investors. In the other hand, Mario holds the great northern European stick of what he repeatedly called ‘strict and effective conditionality’. Indeed Mario promised a stick more flesh-splitting still, holding out the prospect of not only EFSF-ESM supervision, but also IMF involvement as well.

As a former Italian bureaucrat who was closely involved in his country’s successful efforts to avoid structural reforms in the 90s and 00s, Mario knows better than most that you need to point the gun directly at the heads of club-Med types such as himself.

If conditionality is agreed, and sov’ bond buying in the primary market goes ahead, it will be known as OMT. We must be careful not to confuse this with OMD. OMT means Outright Monetary Transactions. OMD was the 1980s’ band Orchestral Manoeuvres in the Dark. Clearly, the two things are unrelated.

Mr Market, meanwhile, is very happy. He continues to believe that Flexible Mario’s pronouncements mean that Frau Merkel will pick up the tab for Club Med Europe. But it is not so. All that Flexible Mario has done is to prepare the stage on which politicians will play, a point which he repeatedly stressed.

Finally, the other salient point today: Mario claimed there was zero discussion in the ECB council of the possibility of NOT sterilising some of the bond purchases, if they happen. In other words, quantitative easing is not yet under discussion.

Comic interlude of the day:

Some genius from Fox News asked Mario how dangerous it is that the ECB already has bonds to the value of 33% of Euro-area GDP on its balance sheet. The ECB balance sheet actually contains bonds to the value of about 3% of Euro-area GDP. Yo, Murdoch…

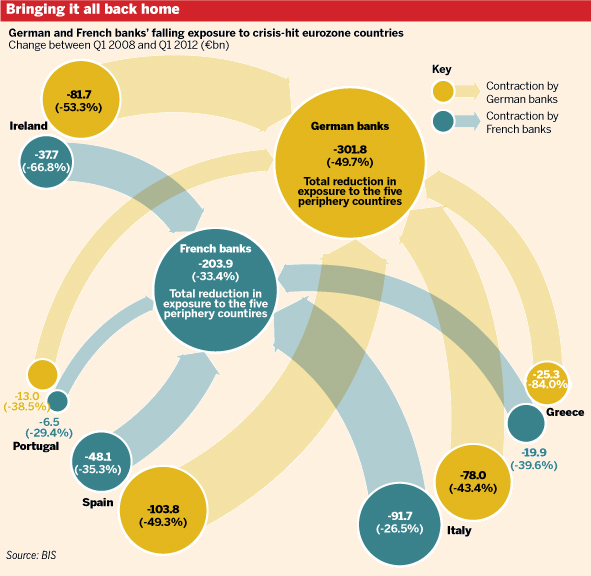

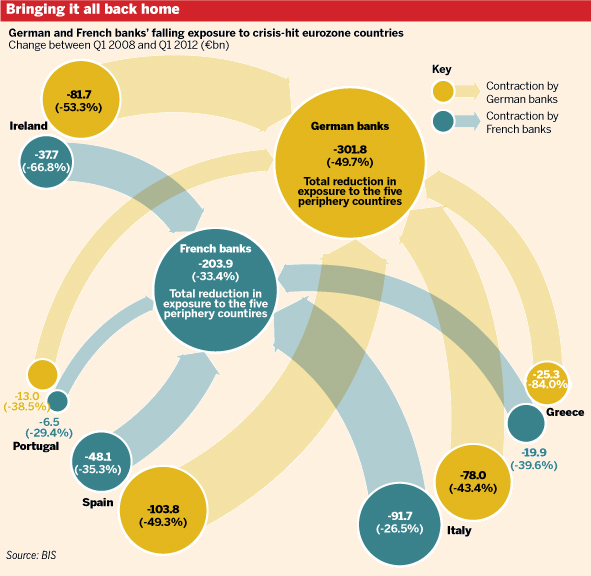

Graphic of the day

This BIS graphic shows how French banks, which had the biggest exposure to the mess to begin with, have also been slower than their German counterparts to unwind their exposure to ‘peripheral’ Europe. Put another way, when you are very deep in ‘le poo poo’, it is that much harder to climb out.

Forgot to mention:

Since the cavalry are mounting up, I should repeat my little ditty of December 2011…

IMF, IMF, riding as to war

We all hope you will not be…

As clueless as before

Oh! [repeat indefinitely until IMF arrives]

What is it with the FT and Italians?

The FT’s love affair with Monti spilleth over (sub needed) even unto Draghi… I can only assume it is because the badly-dressed FT journalists suffer well-cut suit envy.

Email, Print, TwittyFace this post:

Like this:

Like Loading...