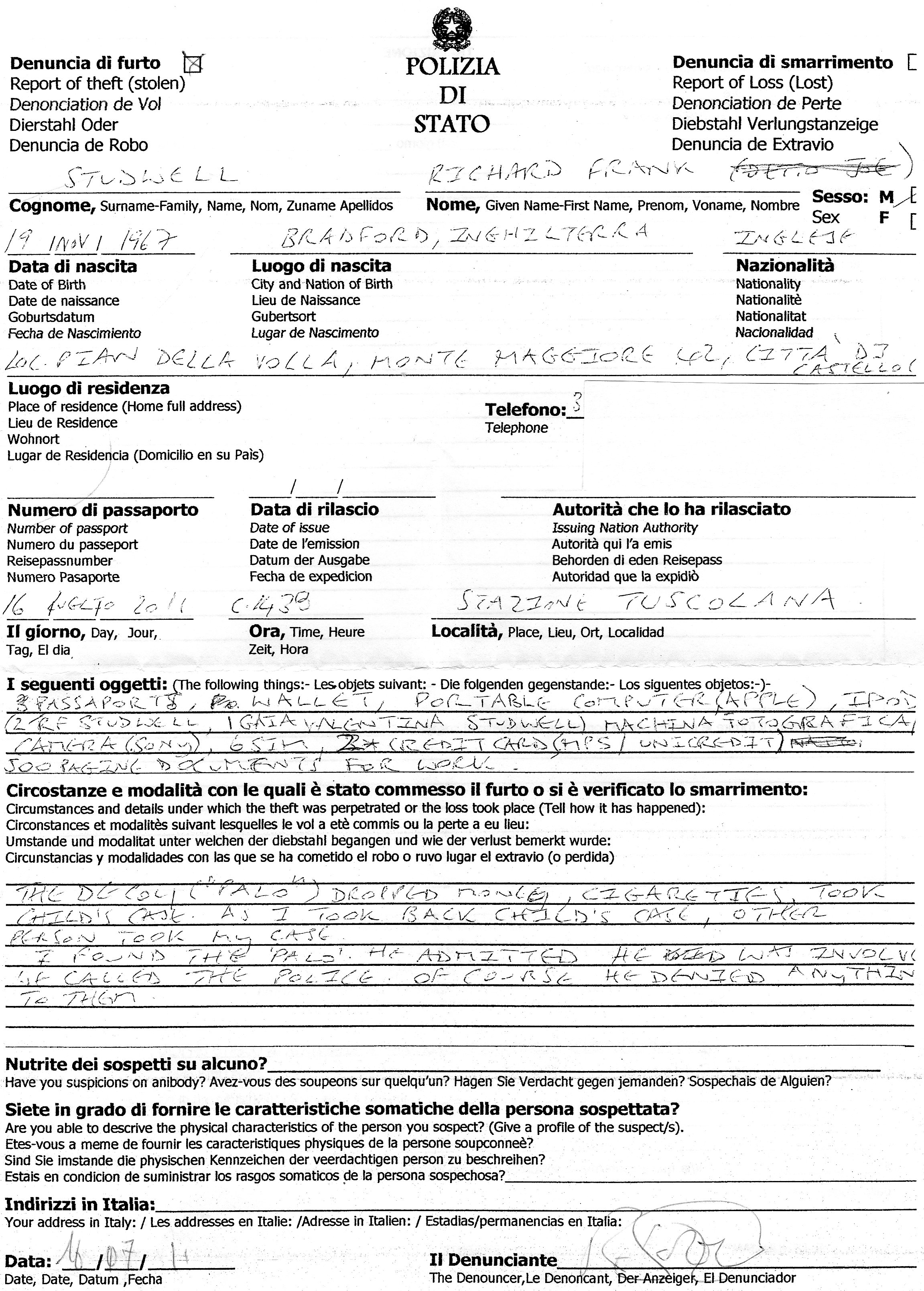

The attentive reader will recall that having been robbed for the second time on the Fiumicino airport-Rome trains on 16 July I contacted ‘Dottoressa’ Caccia, responsible for statistical data at Italy’s Railway Police (Polfer) and that she told me to send my written enquiries to the ‘scrivici’ (‘write to us’) web site of the state police. This site only allows a maximum 600 character (approximately 100 word) enquiry, so I had to be short and specific:

…

Sono stato rubato per la seconda volta a bordo il treno che porta a/dal l’aeroporto Fiumicino. Ho parlato con Dott. Caccia nel ufficio Polfer a Roma e vorrei avere i seguenti dati.

1. Il tot. annuale di denuncie di reato sulle linea Fiumicino-Termini e Fiumicino-Tiburtina nei ultimi 5 anni (meglio ancora dal 2004).

2. Una conferma che questi dati contengono TUTTE le denuncie fatte — o sul modulo in lingue straniere o sul modulo tradizionale in Italiano.

3. Vorrei sapere se mantenete dati per il numero di giorni al anno che le telecamere sul binario 26 della stazione Termini non funziano (per guasti or altri motivi.) Se ci sono dati pubblici, vorrei ottenerli.

…

Let’s be honest that the Italian is not great, but nor is it difficult to understand.

The big surprise was that a section of the state police did reply:

…

Gentile signor Studwell,

la ringraziamo per aver contattato il Dipartimento di Pubblica Sicurezza fornendo utili segnalazioni sui furti che avvengono sui cosiddetti “treni a rischio”, in particolare nella tratta Roma-Fiumicino.

Siamo molto spiacenti per i furti che ha subito in due diverse occasioni su tali treni, faremo sicuramente tesoro delle sue utili indicazioni.

Premettendo che il nostro Ufficio è preposto esclusivamente al contatto con i referenti dei media, vorremmo comunque darle alcuni elementi di risposta alla sua richiesta in merito ai dati sui furti in danno dei viaggiatori.

Dal 2004 al 2010 è stata registrata una diminuzione delle denunce di furto pari al 62% per quanto riguarda gli episodi di furto in stazione ed al 45% per quelli a bordo treno. Il periodo gennaio – luglio 2011, confrontato con l’analogo periodo del 2010, ha fatto registrare un ulteriore calo dell’8% per i furti in stazione e del 21% per i furti a bordo treno.

Infine vorremmo rassicurarla confermando che i dati sulle denunce comprendono anche quelle effettuate sui moduli in lingua straniera.

Rimaniamo a disposizione per ogni eventuale altro chiarimento.

Cordiali saluti

…

Note the introductory line that ‘Despite the fact we are supposed to deal exclusively with the media [in this office], we would however like to provide you a few elements of response…’

I specifically asked for data on reported thefts on the Fiumicino airport- Rome trains between 2004 and 2010. The reply states that reports of theft in stations and on trains fell respectively 62% and 45% between these dates, without saying where. There are further data about declining reports of theft this year.

The reply further states that the data include all reports filed on foreign language forms (the ones without reference numbers).

Since the press office failed to use a no-reply address (even Italians have tricks to learn) I asked for two clarifications:

…

Grazie per la risposta. Vorrei chiarificare 2 cose.

1. Questi dati sulle denunce che fornite referiscono a quale linea di ferrovia? La prima volta che sono stato rubato ero sul treno Termini-Fiumicino. La seconda volta sulla linea Fiumicino-Tiburtina. Sono due linee diverse. Volete dire che c’e stato questo calo sulla linea Termini-Fiumicino, or Fiumicino-Tiburtina, o dove?

2. Come potete sapere che i dati sulle denunce comprendono quelle effetuati sui moduli in lingua straniera cuando quelli moduli non hanno numeri di protocollo? E perche non contengono numeri protocolli?

…

And here is the reply:

…

I dati si riferiscono alle denunce di reati commessi “in stazione” oppure ” a bordo treno” nel loro complesso, ovevro senza distinzioni di linee o stazioni specifiche. è quindi da intendersi come dato complessivo.

il protocollo è inserito sulla nota di trasmissione della denuncia all’autorità giudiziaria.

nel nostro sistema giudiziario,infatti, tuttti i fatti di reato devono infatti essere comunicati all’Autorità Giudiziaria e per un lavoro più agevole si preferisce questo sistema, ma le confermiamo che tutte le denunce di reati vengono acquisite per i necessari studi sull’andamento della criminalità. siamo noi i primi quindi ad avere intreresse a ricevere denunce e segnalazioni per migliorare i nostri interventi.

Cordialità.

…

The first bit begins to concede that the data provided do not refer to the Fiumicino airport trains… in other words that my enquiry has not been answered.

The second part becomes more interesting, claiming that the police add reference numbers to foreigner reports of crime after the reports are received because the system is ‘piu agevole’, which I would translate as ‘more efficient’ (or you could use ‘smoother’).

I would say that the system is more efficient from the perspective of policemen who want to reduce the amount of reported crime by altering or losing crime reports (see the scans of the forms and discussion here).

But as usual I am wrong, and am reminded that in Italy there is a binding legal obligation on the police to report all crimes to the judicial authority. Moreover, the state police assure, they themselves want to know how much crime is being committed so that they can hone their crime-busting techniques.

…

I asked for a final clarification on the data about reported thefts:

…

I dati che mi avete forniti, allora, sono di tutto l’Italia?

Se uno rilegge l’email originale, non siete stati chiari su questo.

Cordiali saluti,

…

And the final reply:

…

Gentile Signor Studwell,

le confermiamo che i dati che le sono stati forniti sono nazionali.

Cordialità

…

So, yes, they gave me national rail crime report data — and avoided providing anything for the Fiumicino trains, (where Ms Caccia told me on the phone theft is down by ‘at least 85 percent’).

The national data also indicate a big drop in reported thefts.

Do I believe even these national data? I think that given the use of unregistered foreigner reporting forms — which my policeman was so insistent I fill out in preference to an Italian form with a reference number — and given the remarkable obfuscation by the police statistics office, it is very hard to do so. Anecdotally, I haven’t seen anything change in terms of policing at Italian stations and on Italian trains in recent years, so why would reported crime fall so sharply? As I wrote previously, riding back and forth on the airport trains after the July 16 robbery, I was able to watch pairs of extracommunitari wandering the carriages, seemingly looking for victims in the most nonchalant fashion.

In the absence of measurable evidence to the contrary, my guess is that a significant part of what is happening statistically is that crimes on trains are not being added to the statistics. I don’t have more time at present to go into this, but it would be very interesting to know when the foreigner forms were introduced.