Martin Wolf has a nice review of policies of economic austerity employed in different states since the start of the global financial crisis. (You will need an FT sub.) Although he doesn’t articulate it as strongly as I would like, his basic point is simple: the crisis is not a macro-economic problem soluble by austerity. It is a micro-economic problem, or rather two different micro-economic problems.

The first problem, in the ‘Anglo-Saxon’ countries, is the need to re-regulate finance in order to stop bankers taking unreasonable risks with other people’s money. This is sort of being dealt with (including in the UK by the Vickers Commission on which Wolf sat), albeit for me in a somewhat ham-fisted, messy way that will eventually bring us more problems.

The second micro-economic problem is that a bunch of states that developed fast after the Second World War by means of close government control in order to foster industrialisation (Japan, Italy, France are the main ones) need micro-economic deregulation, especially of their labour markets and government and legal institutions, in order to return to growth and pay off the large debts they built up while becoming rich countries.

So the crisis (or two distinct crises), as Wolf writes today, has very little to do with macro-economics and is, in general, made worse by austerity. If it has taken you a while to wake up to this, however, do not fear. For in Britain we have the person who will perhaps be the last in the entire world to understand what is going on around him: George Osborne.

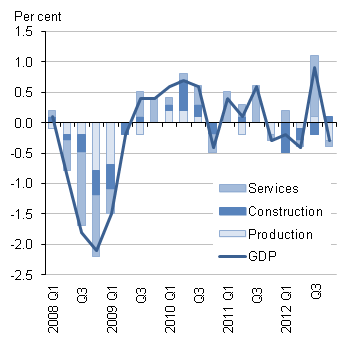

I haven’t written anything about George since the UK’s loss of its AAA credit rating, because there is nothing to add. Here is what I said about George in January 2011. And here is an update from November 2011. What happened since? Looks to me like four out of the past five quarters showed negative growth. The graph below is from the Office of National Statistics…

Ten days later:

Martin Wolf follows up with another attack on Osborne’s policy (FT sub needed), which Brave Dave has come out to endorse without reservation. Meanwhile, latest data suggest the chances of a triple dip recession are now as high as 50:50. All I would add to what Wolf says is that the contrast with the early 80s recession turns on the fact there are no major structural adjustments to the labour market that can be made in this crisis to get the economy moving. Unlike in the early 80s, Britain already has a very flexible labour market. This is why (as in the United States and unlike in continental Europe) unemployment has been lower than the scale of economic contraction would suggest. But it also means that monetary policy alone cannot solve the problem and actually discourages many people from undertaking the deleveraging their finances require. Back in 2010 I thought Osborne would realise this within a couple of years and listen to Vince Cable. Ho, ho, ho…

Tags: bank reform, banks, British politics, financial crisis, George Osborne