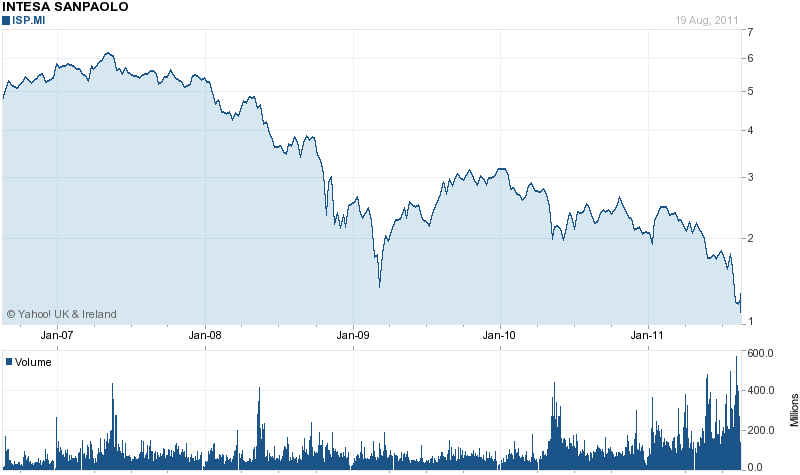

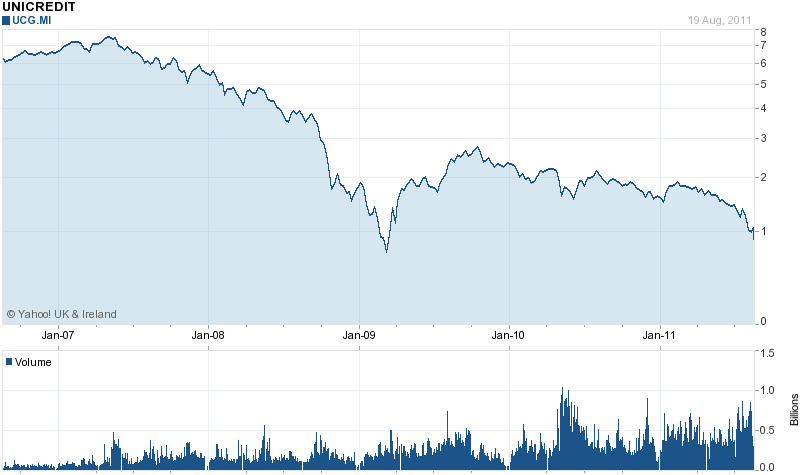

Here’s a weekend snapshot of the death throes of Italy’s financial system…

Both Intesa and MPS are well below their previous financial crisis lows of March 2009.

On recent trends, next week should see all three big banks in decimation territory. The main reason, as discussed here, is their exposure to Italian public debt.

When a bank’s share price is decimated, what happens? Other banks will not lend to it, lest they fail to get their money back. The interbank market closes its door. That may already be happening since the ECB conceded this week that it extended significant funds to one unnamed institution.

As well as buying up all Italy’s debt as it rolls over, the ECB may in the next few days begin funding all its banks as well.

Still, as Frau Merkel and Sarko like to point out, it’s not like they have agreed to issue Eurobonds.

We should get a number on Monday for what the ECB spent in the full week up to last Wednesday on Italian (and Spanish) public paper. My guess is we are in for a monster. Northern European taxpayers will want to avert their eyes.

My own bank is Monte dei Paschi (motto: ‘Medieval bank, medieval service’). I was in there on Friday, discussing the unannounced interruption of my e-banking service (apparently anyone who had not used it for three months was cut off for ‘security’ reasons; I have now been restored). The friendly staff, in their ridiculously spacious branch, didn’t seem fazed by the fact their employer’s market capitalisation is now less than US$3 billion and headed for zero.

Perhaps they think it will be more fun working for a foreign bank? I very much doubt it will be. When the IMF comes in, MPS has to be the prime candidate for takeover by a foreign institution (HSBC? StandardChartered?). My guess is that Italy will be forced to throw at least one of its big banks to the foreign dogs in order to satisfy the IMF’s deregulation strictures, and number three is perhaps the most likely to go. MPS has so far survived 540 years, but this one may be a year too far (though I do not know to what extent MPS’s incorporation structure provides a defence against takeover… it may appear to provide protection, but when the IMF shows up, all bets are off).

Hold on tight now.

Update, Monday 22 August:

The ECB today confirmed Euro14 billion of government bond purchases under its Securities Markets Programme in the week to last Wednesday (11-17 August), less than I had been expecting. Still, we are at Euro36 billion in two weeks, and rising. Meanwhile the Bundesbank explicitly criticises the reactivation of the bond purchase programme in its latest monthly bulletin, jacking up the political pressure in Germany. Stock prices of IntesaSanPaolo and Unicredit continued to fall today, despite a small rebound in European markets; the most bombed-out counter, MPS, rose.

Here is the full history of SMP purchases since May 2010 (ie. Rounds 1 & 2).

Tags: bank reform, banks, financial crisis, Italian politics, Silvio Berlusconi

August 20, 2011 at 6:57 pm

I really don’t understand this. Italian 10 year and 2 year bonds surged two weeks ago on ECB intervention, and since then they have held up perfectly. Why is this banking crisis happening now? And why is there even a need for eurobonds when the ECB is not sterilizing its bond purchases? The ECB can buy Italian bonds forever by expanding its balance sheet. Unlike EFSF, there is no limit. I don’t understand the reason for the crash of the last two weeks.

Joe says: ECB cannot buy bonds for ever because of a thing called politics. (I think there may also be legal restrictions on the growth of its balance sheet.) ECB bond buying of the past two weeks is essentially a back door intervention, with no clear political mandate. EFSF is subject to political oversight which is why it is not being used at present — doing so would involve recognising the enormity of the required debt write-off/adjustment in Italy (and maybe Spain) — much bigger than the current EFSF budgeted maximum, which is also based not on real capital but on notional IOUs from EU governments. The Italian banks are being sold off because the market says, quite reasonably, that the whole situation stinks of bullshit. In other words, in the absence of a political agreement, the market says ‘I don’t want to own this stuff’.

Separately, re. your points, thus far ECB has sterilised its bond purchases because until now they were not very big. And sterilisation, one way or another, has nothing to do with Eurobonds. The case for Eurobonds is to give peripheral Europe German interest rates (again). Naturally Germany and France are reluctant to do this, because instead of bringing itself down, Italy can then screw up the whole Union. Ultimately, however, France and Germany don’t really have a choice because their banks lent Italy much of the money. Hence my prognosis for a solution with ECB money but IMF oversight to make up for the fact that Europe lacks political leadership (i.e. this ain’t the late 1950s).